ACA Affordability Percentage for 2023 and Benefit Plan Design

The Internal Revenue Service recently issued Rev. Proc. 2022-34 - This link will open a PDF document that announced the percentage for determining affordability of employer-sponsored health coverage under the Affordable Care Act (ACA). For plan years starting in 2023, the affordability percentage is 9.12%, which is a significant decrease in comparison to 2022’s affordability percentage of 9.61%.

Impact of the 2023 ACA Affordability Percentage

Under the ACA’s provisions, employers with at least 50 full-time (equivalent) employees must offer health coverage that is both affordable and provides minimum value. Employer sponsored coverage can only be considered affordable if an employee’s required contribution for the lowest-cost, employee-only coverage does not exceed 9.12% (for Plan Years 2023) of the employee’s household income. Given the affordability percentage change for 2023, employers can expect to adjust the employee contribution rates for the 2023 plan year to remain in compliance. Employers that fail to offer an affordable, minimum value coverage option to full-time employees could incur penalties under employer shared responsibility rules.

Testing Affordability

Because household income is often unknown by employers, the IRS created three safe harbor calculations as alternatives to determine affordability:

- Form W-2 wages

- Rate of pay for the employee, based on employee’s hourly or monthly rate of pay

- The federal poverty line, or FPL

Employers can use any one of these three safe harbor alternatives to ensure they are in compliance with the ACA, as long as an employee does not pay premiums higher than 9.12% for the lowest-cost employee-only health coverage option.

Simple, Flexible, and Affordable Solutions

Boon’s minimum value solutions offer employees health coverage options that are efficient, affordable, and sustainable. If your goal is to bring value to your employees, but remain cost-conscious, this is your benefit solution! We offer compliant healthcare benefits, designed with the needs of your business in mind.

Keep Up with Boon!

Have you heard of our newsletter? It’s your source for the latest in industry updates and all things Boon! Sign-up and get the highlights, direct to your inbox.

Never miss a blog post and also keep up with Boon on Facebook, Twitter, and LinkedIn.

Latest News

The ripple effects of inflation can be felt across all sectors of the economy, and healthcare is one area where the impact of inflation is felt keenly. The interconnected nature of economic factors...

The open enrollment season is upon us once again! That time of year when you have the opportunity to review and make changes to your workplace benefits. While it may seem like a mundane task with...

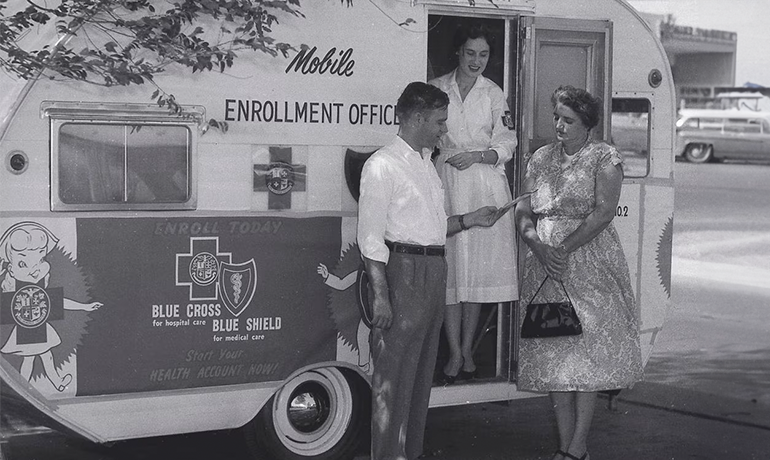

Employee health insurance has become an indispensable aspect of modern American workplaces, ensuring the well-being of workers and their families. This crucial benefit we often take for granted has a...