Navigating Your Open Enrollment and Making Smart Benefit Selections

The open enrollment season is upon us once again! That time of year when you have the opportunity to review and make changes to your workplace benefits. While it may seem like a mundane task with little importance, choosing your benefits is a critical decision that can significantly impact your financial well-being, health, and overall quality of life. In this blog, we’ll explore what open enrollment is, why it matters, and how to navigate your open enrollment period to make informed choices that align with your needs and goals.

What is Open Enrollment?

Open enrollment generally refers to the annual period during which eligible employees can review and decide what benefits to enroll or continue to enroll in that are being offered by your employer or otherwise being made available, such as health insurance and voluntary benefit options. This window of opportunity typically lasts a week or two, and generally occurs at the same time each year. For employer-sponsored plans that follow the calendar year, open enrollment is generally at some point in the Fall of each year. During open enrollment, employees can:

- View all benefits that are being offered by the employer

- Enroll in new benefits that you are eligible for

- Make changes to existing benefit elections

- Renew your benefit selections

Why Does Open Enrollment Matter?

Benefit elections can carry a heavy impact on the care and finances that you and your family receive and have available to you during the coming year, and there are several factors that make your next upcoming open enrollment period important. Decisions such as type of health, dental and vision insurance to choose; PPO, HMO, or HDHP, whether a particular voluntary benefit is right for you and at what coverage level, and how much to contribute to a retirement benefit should each be weighed carefully, both individually and collectively.

Health, financial wellness, and peace of mind are all examples of how the decision made during an open enrollment matter. Healthcare benefits, in particular, is often considered one of the most valuable benefits offered by employers and picking the right coverage for you requires consideration of factors like personal health, size of family. You should also closely review the plan premiums, deductibles, and coverage networks available under each offering. There are also tax saving options that provide additional savings, like health savings accounts, flexible spending accounts, and dependent care flexible spending accounts.

Making Smart Benefit Selections

First, we suggest that you begin with a careful examination of your current benefit elections and take note of what worked well over the past year. For example, what you paid for premiums during the past plan year and whether you feel like you received the value for the money spent. For individuals that got married or welcomed a child, don’t forget to make sure that these new dependents are included in this assessment.

An employer has great flexibility in the benefit offerings made to eligible employees. Take the time to understand the different features of each option, including the associated costs such as premium cost, deductible, copay amounts, and out of pocket maximum, as well as the covered services and provider network. In most work environments, the human resource team is available to explain the documents provided and can answer questions. Additionally, a benefits expert may be on hand during open enrollment to help guide you in making the right decision for you and your family.

Navigating Your Open Enrollment Period

It’s amazing that such a short window of time can provide such a valuable opportunity to help shape the financial and physical preparedness and wellbeing for the coming year! By taking the time to carefully evaluate the options being offered by your employer and your needs for the upcoming year, you can make an informed decision that serves you well in the year ahead.

Remember to make the most of this annual event!

Keep Up with Boon!

Have you heard of our newsletter? It’s your source for the latest in industry updates and all things Boon! Sign-up and get the highlights, direct to your inbox.

Never miss a blog post and also keep up with Boon on Facebook, Twitter, and LinkedIn.

Latest News

The ripple effects of inflation can be felt across all sectors of the economy, and healthcare is one area where the impact of inflation is felt keenly. The interconnected nature of economic factors...

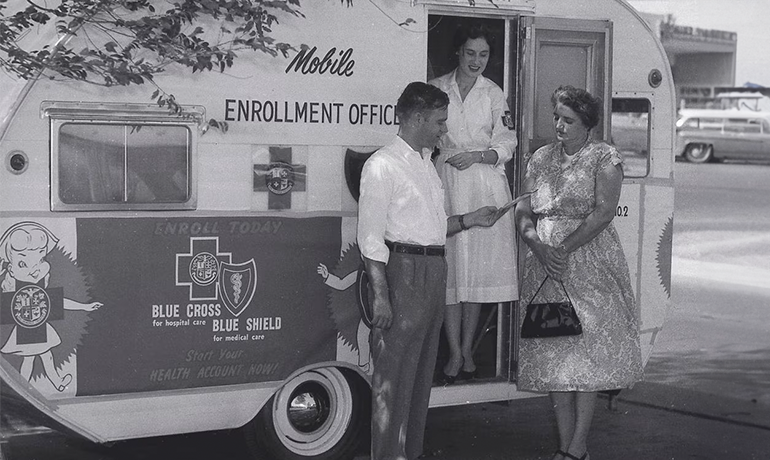

Employee health insurance has become an indispensable aspect of modern American workplaces, ensuring the well-being of workers and their families. This crucial benefit we often take for granted has a...

The Internal Revenue Service recently issued Rev. Proc. 2022-34 - This link will open a PDF document that announced the percentage for determining affordability of employer-sponsored health coverage...