In the current landscape, employee benefits have become even more valuable to employers and their valued workforce. It’s not just an emphasis on providing benefits, however. Government contractors, commercial employers, and businesses of all sorts are seeking a way to reduce their burden and get maximum value while still conserving their resources, time, and efforts. Benefits administration can be a particularly overwhelming challenge, which is why many employers turn to the expertise of a TPA service.

What Does a TPA Service Do?

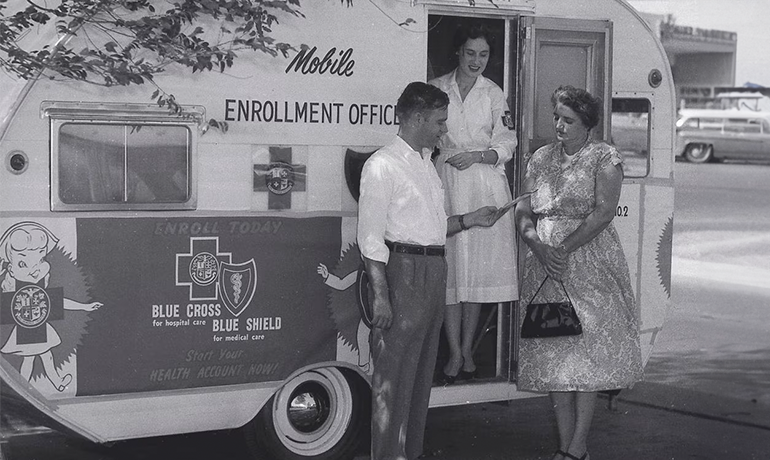

A third-party administrator, or TPA, is a company that provides operational and administrative services under contract to another company. A TPA service will handle an array of services for employer-sponsored group health plans and benefit trusts, like claims processing, receiving premium contributions, and employee benefits management.

Some businesses will choose an ASO, or administrative services only, solution in lieu of the full administrative options of a TPA service. ASO is a type of self-funded healthcare that allows an employer to provide healthcare or disability benefits by using the company’s own funds to pay claims. It’s common for employers that offer self-funded benefits to hire a TPA service to handle administrative tasks like enrollment, accounting, and collecting contributions to the plan.

Why Businesses Turn to Third-Party Administrators.

Third-party administrators offer their clients a wealth of knowledge and expertise. TPAs understand the ins-and-outs of employee benefits, health insurance, regulations and compliance, and how all of those concepts intersect. This savvy allows the TPA to provide guidance to employers and properly monitor their benefits administration, freeing up businesses to focus on other important tasks.

In the commercial space, where many businesses utilize hourly benefits for their employees, properly tracking hourly benefits at the individual employee level can be overwhelming! Still, as the current market shows, offering benefits is a boon to employers. A TPA service is perfectly equipped to the do the necessary hourly tracking, simplify employee benefits administration, and will have plenty of knowledge about legal requirements for employer-sponsored health plans.

For government contractors, issues of compliance and benefits administration are only made more complicated by the introduction of fringe benefits! Government contractors may choose to put the fringe amount towards bona fide fringe benefits, in lieu of paying the fringe out in cash, to benefit from the cost-saving advantages and reduced payroll tax burden. Managing fringe contributions and maintaining compliance is no simple task! Fringe accounting and administration takes a great deal of labor and resources to properly track fringe dollars for each employee working on a contract. A TPA service can save government contractors a lot of trouble!

Boon: A Trusted TPA

As a third-party administrator, Boon is committed to taking the guesswork out of benefits administration. We offer our clients an expert in their corner. With three decades of industry expertise, a host of TPA services, and benefit solutions carefully tailored to each client’s needs. Our services include hour bank administration and paid leave accounting, fringe contribution collecting, audit trail accounting, and much more!

Keep Up with Boon!

Have you heard of our bi-monthly newsletter? It’s your source for the latest in industry updates and all things Boon! Sign-up and get the highlights, direct to your inbox.

Never miss a blog post and also keep up with Boon on Facebook, Twitter, and LinkedIn.